Export and import are the two most important activities in the economy of every country, especially in the fields of logistics and supply chain management. These actions not only support domestic goods entering foreign markets but also facilitate foreign goods entering the domestic market.

What are customs procedures and customs procedures for importing and exporting goods in Vietnam

Customs procedures are the necessary steps for importing and exporting goods in Vietnam. Customs clearance is a mandatory procedure in which the customs authority of a country performs necessary tasks to inspect whether the exported goods comply with the laws.

In other words, customs procedures are the processes for importing and exporting goods and modes of transport into a country. These are mandatory procedures that must be followed for goods and modes of transport to be imported or exported or to cross the borders of a country.

It should be noted that customs procedures apply only to goods and modes of transport, not to individuals. In Vietnam, security agencies or border guard customs handle the entry and exit procedures for individuals.

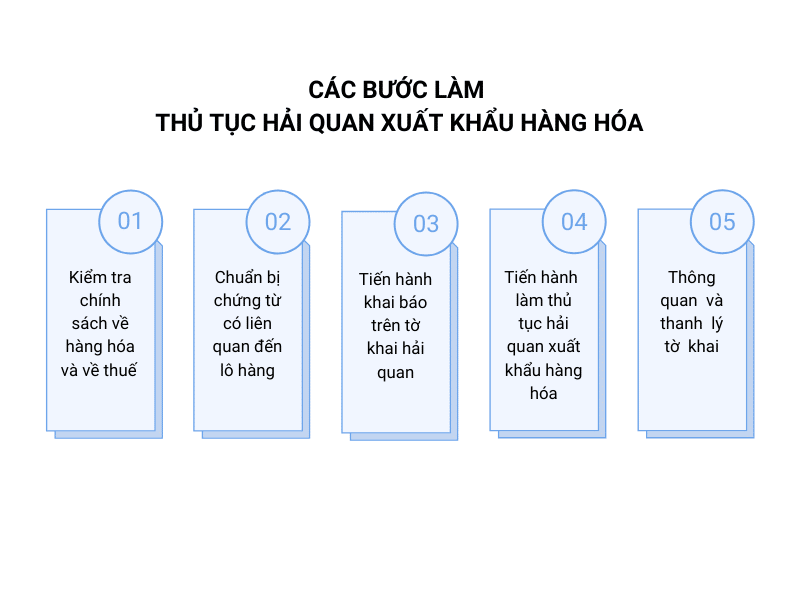

Steps for customs procedures for exporting goods:

1. Review product policies and tax policies:

Not all goods are allowed to be exported abroad. Therefore, the first important step is to check if the goods are on the prohibited goods list. The list of goods banned from export is specified in Decree No. 69/2018/ND-CP dated May 15, 2018 of the Government.

Negotiate and sign foreign trade contracts with foreign partners once you understand the main relevant policies, proceed to the next steps in the customs clearance procedures for export goods

.

2. Prepare documents:

The document requirements for regular goods that do not require specialized inspections are relatively simple in most cases. Most of the documents you need to send to foreign buyers are mandatory.

Prepare the following documents for customs declaration and customs procedures for importing and exporting goods:

– Sale Contract

– Commercial Invoice

– Packing List

– Booking Note: to obtain information about the vessel name, voyage number, port of export

– Container confirmation receipt: to obtain container number, seal number

In addition, prepare specific documents according to current regulations for specific goods that require specialized inspections.

3. Declare customs declaration

Đối với hàng hóa xuất khẩu, nhập khẩu vào nước ta, tờ khai hải quan là chứng từ được chủ hàng sử dụng để khai báo hàng hóa với lực lượng kiểm soát. Dựa trên các thông tin có trong các chứng từ nói trên, bạn tiến hành vào phần mềm hải quan điện tử và nhập các thông tin cần thiết, đồng thời là tờ khai hải quan.

Các doanh nghiệp mới bắt đầu tham gia vào lĩnh vực xuất nhập khẩu phải thực hiện một số bước bổ sung. Ngoài ra, bạn có thể sử dụng chính chữ ký số mà bạn dùng để kê khai thuế, bảo hiểm xã hội; tất nhiên, phải đăng ký chữ ký số đó với Tổng cục Hải quan trước (hệ thống VNACCS).

4. Complete customs procedures for importing and exporting goods:

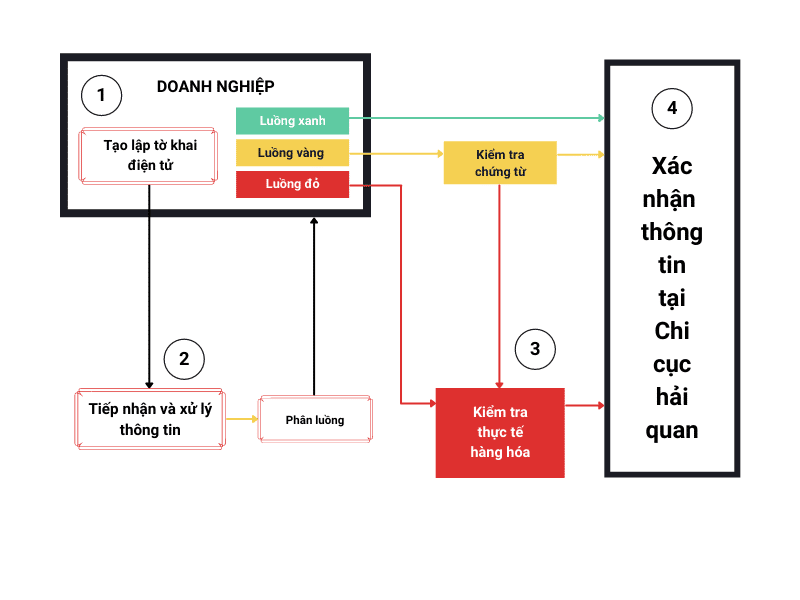

The declaration will be classified based on the declaration information you have provided. The speed of your shipment will vary depending on the flow. Currently, there are three main flows:

– Green lane declaration: In this case, the products are always cleared under the program, reducing the time for activities and allowing faster shipment.

– Yellow lane declaration: Comprehensive documents of the shipment will be physically inspected in this flow, but not the actual products. After the documents are approved, the shipment completes the procedures in step 4.

– Red lane declaration: It requires the most time and effort from both sides. Detailed documents and the shipment will be physically inspected in this flow. If there are no further issues after the inspection, the customs authority approves the documents and proceeds to step 4.

TS24's electronic customs services have been recognized by the General Department of Customs since 2012 to support businesses/organizations in carrying out customs clearance and electronic port fee declaration services. With the aim of making customs procedures easier for businesses, C-VAN iHaiQuan is continuously improved to better serve businesses.

- With just one application, iHaiQuan can create customs files for 3 types of business: trade, manufacturing-exporting, and processing..

-

It meets the V5 and VNACCS standards and automatically updates with new government policies.

5. Customs clearance and declaration settlement:

After completing the above 4 steps and your declaration has been cleared, you only need to submit the declaration and barcode to customs supervision for authentication. Once the declaration has been cleared and passed customs supervision, you must submit it back to the shipping company for their customs supervision to complete the export procedures when the goods are loaded onto the ship.

Therefore, after completing the above 5 main procedures, you have completed the customs procedures for exporting in particular and customs procedures for importing and exporting goods in general. To ensure seamless implementation, you should also pay attention to the legal regulations related to export procedures.

iHaiQuan - An electronic customs service recognized by the General Department of Customs since 2012.