Goods exported, imported, and transiting into/out of the territory of Vietnam must undergo customs procedures and be subject to customs inspection and supervision in accordance with Vietnamese laws.

According to the explanation in the Customs Law of 2014:

23 Customs procedures refer to the activities that the declarant and customs officials must carry out in accordance with the provisions of this Law regarding goods and means of transportation.

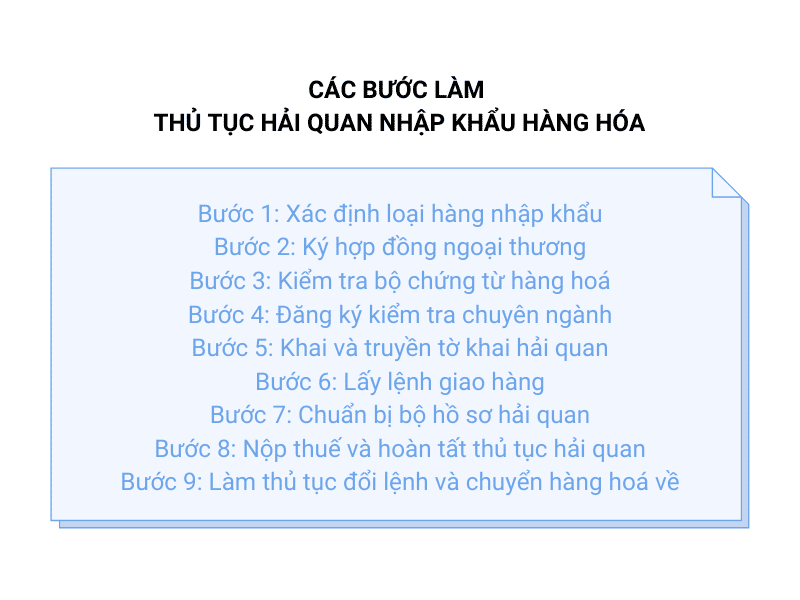

Steps to carry out customs clearance procedures for import of goods

Step 01: Determine the type of goods to be imported

It is necessary to determine the category or classification of the imported goods in order to identify the required procedures. For example, if it is regular goods (allowed for import), there is no special consideration needed. However, if the goods require conformity assessment or standard compliance, the company must complete the necessary conformity assessment procedures before the goods are brought to the port.

Common goods (allowed for import), prohibited goods, goods requiring import licenses, goods requiring full standard compliance, and goods requiring specialized inspections are all examples of different types of goods.

Step 02: Enter into a foreign trade sales contract (Sales Contract)

A sales contract is an agreement between the seller and the buyer. The contract should contain sufficient information such as the name of the goods, quantity, weight, price, etc. Additionally, the contract specifies a range of other restrictions related to documents and payment methods. When declaring customs import procedures, the contract is the most important document.

Step 03: Check relevant documents and records

The essential set of documents in customs procedures includes the following:

- Sale Contract: The trade agreement between the parties involved.

- Bill of Lading: The document that provides details about the shipment of goods (3 original copies).

- Packing List: A document specifying the packaging details of the goods (3 original copies).

- Commercial Invoice: An invoice that contains information about the transaction (3 original copies).

- Certificate of Origin: A document certifying the origin of the goods.

Typically, the seller will send these documents to the buyer. Therefore, to avoid time-consuming procedures, it is important to carefully review the information in these documents.

Step 04: Register for specialized inspections

If the imported goods fall under the category of goods that require specialized inspections, it is necessary to follow the procedures for specialized inspections as stipulated by the law.

Step 05: Declare and submit customs declaration

When the shipping company sends the cargo notification, the business needs to proceed with the customs declaration and provide all the necessary information on the declaration form.

To complete the electronic customs procedures, you will need a digital signature and declare customs through the iHaiQuan software or the General Department of Customs website. Once the declaration is completed and submitted, the system will automatically issue a declaration number if the information is accurate and complete.

Step 06: Obtain delivery order

This is a document provided by the shipping company or freight forwarder to hold the goods for delivery at the port or warehouse.

The business needs to prepare the following documents and bring them to the shipping company to obtain the delivery order:

- Copy of ID card/Citizen ID card.

- Copy of the bill of lading.

- Original stamped bill of lading.

If the goods have already been loaded into the container, you need to determine whether there is time to store them at the port or warehouse before extending the storage period.

Step 07: Prepare customs documentation

After the customs declaration is submitted, the system will categorize the goods into green lane, yellow lane, or red lane, similar to export procedures.

- Green lane: The business prints the declaration and pays the taxes.

- Yellow lane: Customs officials inspect the documentation for the shipment.

- Red lane: The goods are subjected to physical inspection.

Step 08: Pay taxes and complete customs procedures

After the customs declaration has been submitted and cleared, the business needs to proceed with paying two main types of taxes:

- Import tax.

- Value Added Tax (VAT).

Additionally, depending on the type of goods, there may be additional taxes such as environmental tax or special consumption tax.

Once the customs procedures are completed, and all the required taxes have been paid, the imported goods are successfully cleared through customs.

Step 09: Complete shipment transfer and goods entry into the warehouse

Carry the existing Delivery Order (D/O) along with the sender's introduction letter, the container's shipping note from the shipping company, and the barcode of the signed customs declaration. After preparing the transportation vehicle, proceed to the goods entry into the warehouse. Subsequently, the customs authorities will inspect the goods, and if necessary, create a fee submission dossier. Once all the procedures are completed, the goods will be transferred to you.

iHaiQuan - The electronic customs service has been officially recognized by the General Department of Customs since 2012.